August 13, 2025

5 min read

admin

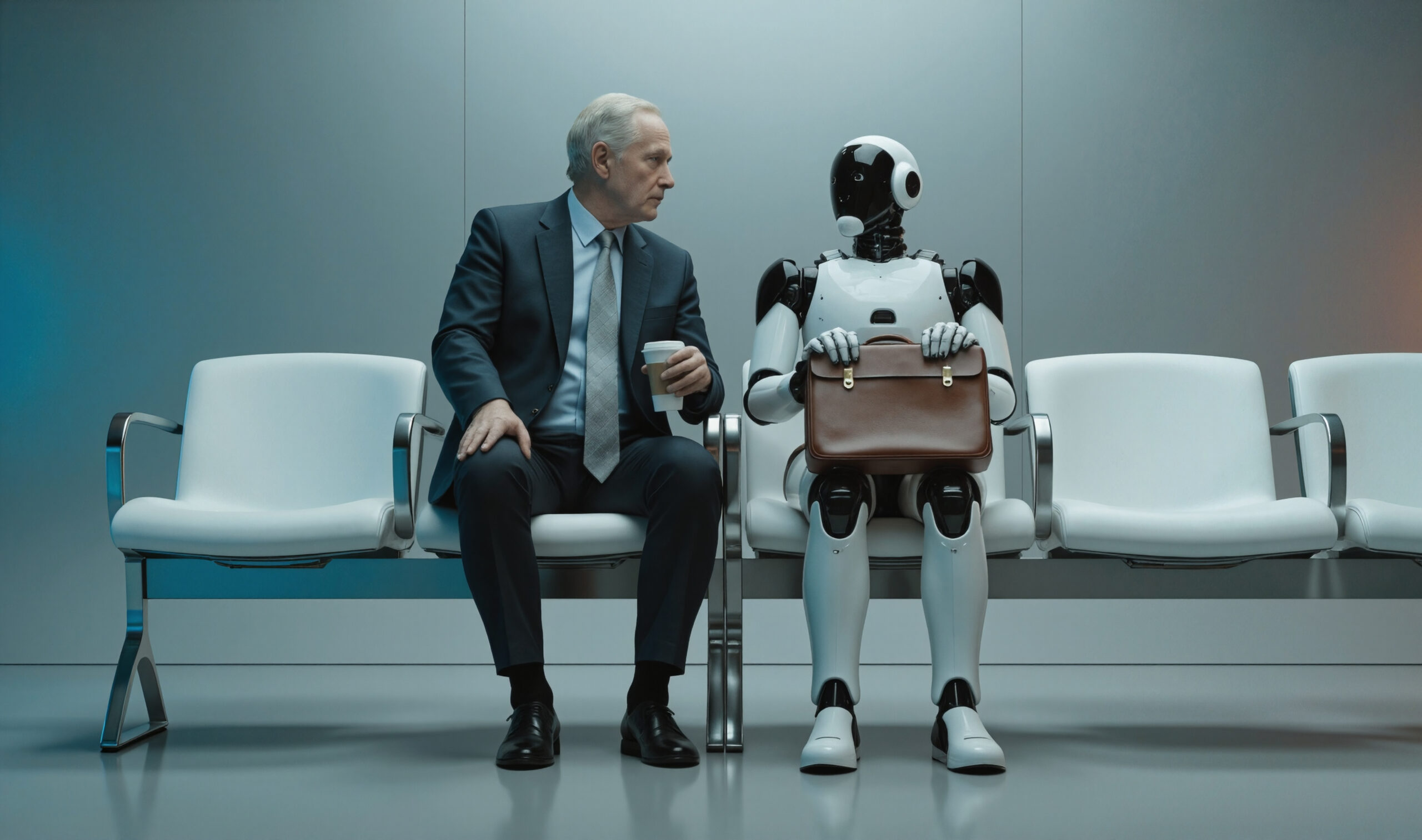

Insurtech Superagent AI to Launch Fully Autonomous AI Insurance Agents by 2026

Insurtech company Superagent AI announced its ambitious goal to launch the first fully autonomous AI insurance agent by the end of 2025. “We’re not just reshaping insurance. We’re redefining what it means to be an insurance agent,” said Milan Veskovic, CEO of Superagent AI. “Our fully autonomous AI agents will eliminate human error, offer superior client interactions 24/7, and fundamentally alter industry expectations.” Founded this year and based in San Francisco, Superagent AI plans for its AI agents to handle insurance advisory, sales, and customer service around the clock—more efficiently than traditional human agents. The company anticipates intense industry debate and predicts that traditional insurance agents will need to drastically evolve or risk obsolescence. Superagent AI welcomes dialogue with the insurance community on this transformation. Superagent AI envisions a new operating model where one human manager oversees multiple AI insurance agents. “Human agents will evolve from individual contributors to strategic managers overseeing AI-powered sales teams,” the company explained.Interim Solutions: BOOT|camp and LIVE|assist

Before the full autonomous agents launch, Superagent AI will debut two flagship products in September: BOOT|camp and LIVE|assist. These solutions aim to:- Cut new-hire ramp-up time by up to 50%

- Boost close rates by double digits

- Reduce average call-handle time They achieve this through AI-driven training, real-time call assistance, automated objection handling, compliance alerts, and intelligent client engagement prompts. Clark A. Fisher, a district manager at Farmers Insurance, praised these products, stating, “If this is just the beginning, I can’t imagine how agencies will compete without AI agents in the future.”

- AI Agents are Revolutionizing Business Automation and Customer Engagement

- How AI is Transforming the Insurance Industry

Pricing and Availability

Superagent AI offers a single AI insurance agent subscription at $299 per month, a suite of six agents for $1,000 per month, or customizable solutions tailored to client needs.Photo: Generated with AI, AdobeStock

Tags

Trends| Agencies | InsurTech | Artificial Intelligence |

Source: Originally published at Insurance Journal on August 13, 2025.