July 31, 2025

5 min read

@CryptoRank_io

Lemonade’s AI-driven insurance platform is poised for growth with bullish projections after its August 5 Q2 results release.

AI stocks are rapidly emerging as a key investment domain, with artificial intelligence increasingly integrated across major industries. This trend is driving investors toward AI stocks that promise transformative growth potential.

Among these, Lemonade, an innovative insurance company, is gaining significant attention. The company specializes in renters, homeowners, pets, life, and car insurance, leveraging AI through its chatbots Maya and Jim. These AI agents efficiently process claim requests and ensure timely payouts without human intervention, streamlining what has traditionally been a tedious claims process.

According to Motley Fool’s analysis, Lemonade is expanding aggressively, aiming to grow the total value of premiums from outstanding policies to $10 billion over the next decade. The company is also set to release its Q2 financial results on August 5, 2025, which analysts expect will drive bullish momentum in its stock.

Lemonade’s AI technology is highly adaptive, capable of shifting market narratives dynamically. The firm has developed new lifetime value (LTV) models that predict policyholder claim behaviors, helping to determine the likelihood of future claims and optimize premium pricing for individual customers.

Investors should watch the August 5 earnings release closely, as it may serve as a catalyst for a parabolic move in Lemonade’s stock price.

Investors should watch the August 5 earnings release closely, as it may serve as a catalyst for a parabolic move in Lemonade’s stock price.

Source: Originally published at Watcher.Guru on July 30, 2025.

“As an example, in just over a year, we went from a standing start to having comprehensively rolled out generative AI platforms to handle incoming customer communications. We handle email and text communications coming in. We’re now handling more than 30% of these interactions with absolutely no human intervention.” — Lemonade CFO Tim Bixby

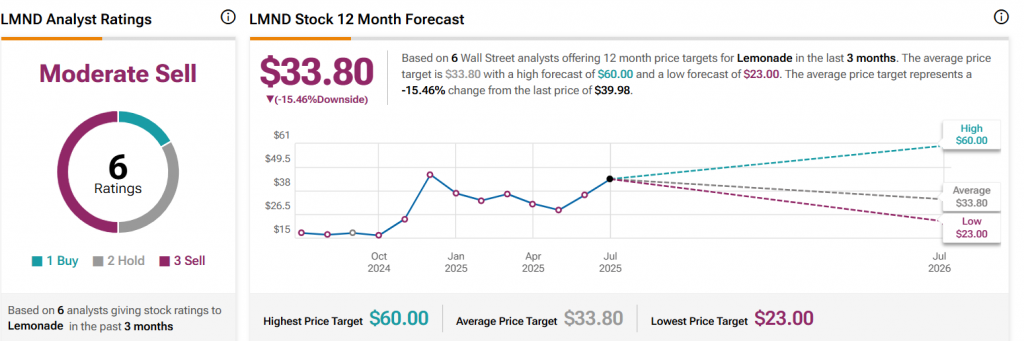

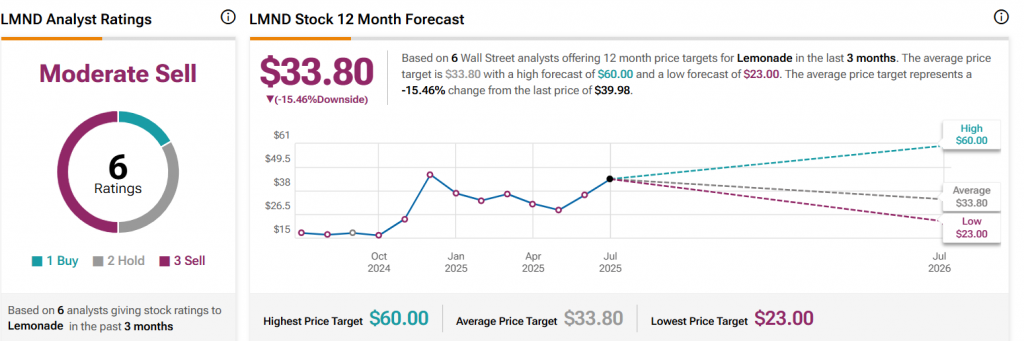

Lemonade Stock Projections

Per TipRanks, Lemonade (LMND) has a wide range of analyst price targets. The average price target is $33.80, based on six Wall Street analysts’ 12-month forecasts, with the highest target at $60.00 and the lowest at $23.00. The current stock price is approximately $36.53, indicating mixed sentiment but potential for significant upside. Investors should watch the August 5 earnings release closely, as it may serve as a catalyst for a parabolic move in Lemonade’s stock price.

Investors should watch the August 5 earnings release closely, as it may serve as a catalyst for a parabolic move in Lemonade’s stock price.

Source: Originally published at Watcher.Guru on July 30, 2025.