July 31, 2025

5 min read

@CryptoRank_io

Lemonade leverages AI to revolutionize insurance claims and is poised for a bullish surge after its August 5 Q2 results release.

AI stocks are rapidly becoming a prime focus for investors as artificial intelligence integrates deeply into various industries. Insurance is one such sector undergoing transformation, with AI enabling companies to expand and improve their services.

Among these, Lemonade stands out as a leading AI-powered insurance company specializing in renters, homeowners, pets, life, and car insurance. The company uses advanced AI chatbots named Maya and Jim to process claim requests and ensure timely payouts, all without human intervention. This innovative approach streamlines the traditionally tedious claims process, making it seamless and convenient for customers.

According to Motley Fool’s analysis, Lemonade is expanding aggressively with plans to increase the total value of premiums from outstanding policies to $10 billion over the next decade. The company is scheduled to release its Q2 financial results on August 5, 2025, an event analysts expect will catalyze bullish momentum in its stock.

Lemonade’s AI technology is also dynamic, capable of adapting market narratives and switching strategies quickly. The firm has developed new lifetime value (LTV) models that predict policyholder claim patterns, helping to forecast future claims and determine optimal premium pricing for individual customers.

Lemonade’s AI-driven approach and upcoming financial results make it a stock to watch closely, especially for investors interested in the intersection of AI and insurance.

Lemonade’s AI-driven approach and upcoming financial results make it a stock to watch closely, especially for investors interested in the intersection of AI and insurance.

Source: Originally published at Watcher.Guru on July 30, 2025.

"As an example, in just over a year, we went from a standing start to having comprehensively rolled out generative AI platforms to handle incoming customer communications. We handle email and text communications coming in. We’re now handling more than 30% of these interactions with absolutely no human intervention," said Lemonade’s CFO Tim Bixby in an interview. (Source)

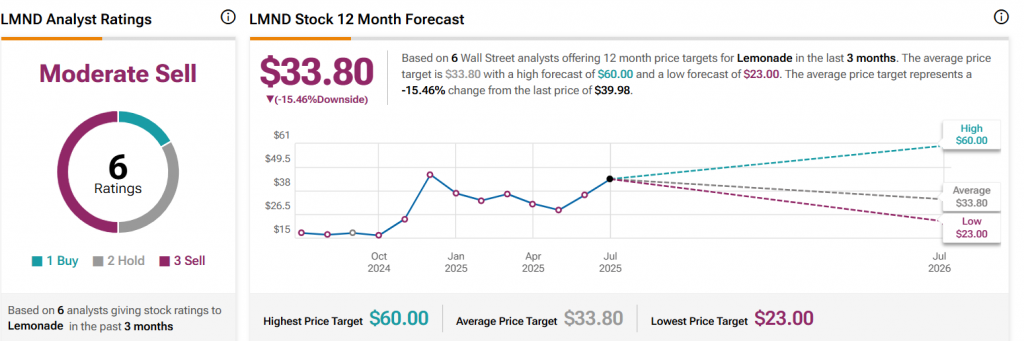

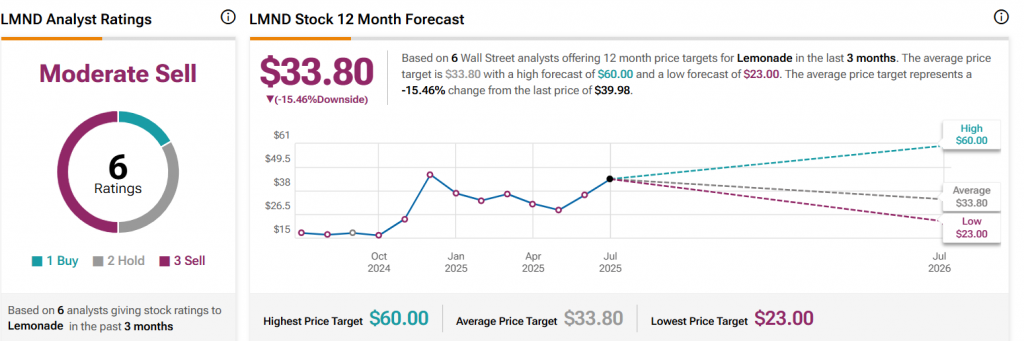

Lemonade Stock Projections

Based on TipRanks data, Lemonade (LMND) has a potential upside with a price target reaching up to $60 within the next 12 months. The average price target from six Wall Street analysts is $33.80, with a range between $23.00 and $60.00. While the average target suggests a slight decrease from the current price of $36.53, the highest target indicates significant growth potential. Lemonade’s AI-driven approach and upcoming financial results make it a stock to watch closely, especially for investors interested in the intersection of AI and insurance.

Lemonade’s AI-driven approach and upcoming financial results make it a stock to watch closely, especially for investors interested in the intersection of AI and insurance.

Source: Originally published at Watcher.Guru on July 30, 2025.