Building a cryptocurrency portfolio takes more than picking a few trending tokens. It’s about setting clear goals, understanding your risk tolerance, and putting structure around how you invest.

The right mix of assets can help you ride out volatility and stay positioned for long-term gains. From defining your investor profile to choosing strategies and rebalancing, every step matters in shaping results.

Key Takeaways

- A cryptocurrency portfolio is a structured mix of digital assets, designed to balance risk and reward based on your investment goals and risk tolerance.

- Defining your investor profile—conservative, balanced, or aggressive—is critical before selecting assets or strategies.

- Core strategies include HODLing, dollar-cost averaging (DCA), growth investing, value investing, and technical trading. Each serves a different type of investor.

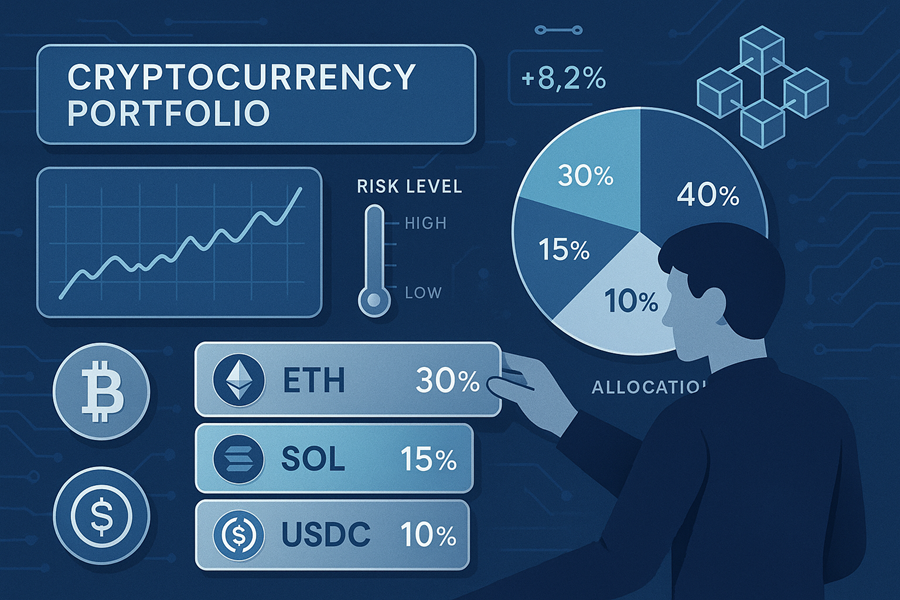

- A balanced portfolio often includes a mix of large-cap coins (like BTC and ETH), altcoins, stablecoins, and tokens from various sectors (DeFi, Web3, infrastructure, etc.).

- Intelligent diversification means spreading exposure across sectors, market caps, and use cases—without overextending into too many assets.

- Rebalancing helps keep your portfolio aligned with your original plan, especially after major market moves.

- Use reliable tracking tools or exchange dashboards to monitor portfolio performance and identify when to make adjustments.

- Avoid common mistakes like overtrading, chasing hype, or ignoring liquidity. Always know why each asset is in your portfolio.

- Advanced investors may explore ICOs, crypto derivatives, and tokenized assets, but these carry higher risks and require greater technical understanding.

What Is a Cryptocurrency Portfolio?

At its core, a

cryptocurrency portfolio is the collection of digital assets you hold. But behind that simple definition lies a structure that reflects your personal investment strategy.

The Nature of Crypto Portfolios

A portfolio may include Bitcoin, Ethereum, altcoins, stablecoins, and governance tokens. Like traditional portfolios of stocks or bonds, the purpose is to manage risk across asset types within one class: blockchain-based tokens.

Why Structure Matters

Unlike traditional markets, crypto runs 24/7 with extreme price swings. Assets can rise or fall 10% in a single day and still be considered “normal.” Without a framework, your holdings are just scattered trades—not a portfolio.

Beyond Speculation

A well-built crypto portfolio balances high-growth potential with stability. It can include foundational assets like Bitcoin, ecosystem leaders like Ethereum, yield-generating DeFi tokens, and stablecoins for liquidity. The goal isn’t to own everything—it’s to own what fits your strategy and tolerance for risk.

Define Your Investor Profile First

Before choosing assets, you must define who you are as an investor. Your profile sets the foundation for every decision.

Risk Tolerance

Conservative investors focus on Bitcoin, Ethereum, and stablecoins. Balanced investors combine blue-chip tokens with mid-cap altcoins. Aggressive investors may chase small-cap projects and emerging DeFi tokens.

Time Horizon

Long-term investors typically follow a HODL approach, while short-term investors rely on trading and rebalancing. Each requires different patience levels and risk management.

Investment Goals

Your goals matter as much as your risk tolerance. Are you building long-term wealth, earning passive income through staking, or seeking exposure to high-growth sectors like AI or gaming? Your objective shapes your portfolio design.

Decide on Your Investment Strategy

A crypto portfolio without strategy is just a collection of bets. Strategy gives structure and keeps emotions in check.

HODLing

A

buy-and-hold approach focused on assets with long-term conviction, such as Bitcoin and Ethereum. Ideal for investors who believe in blockchain’s future growth.

Dollar-Cost Averaging (DCA)

Investing a fixed amount at regular intervals. This reduces emotional decision-making and smooths out volatility over time.

Other Strategies

Value investing looks for undervalued assets based on fundamentals. Growth investing targets projects with expansion potential. Technical trading suits experienced investors who act on price charts and signals.

Choose the Right Mix of Crypto Assets

The right portfolio mix balances growth and protection. Each type of asset serves a different role.

Core Assets

Bitcoin and Ethereum provide stability, liquidity, and proven track records. They often anchor most portfolios.

Altcoins

Tokens like Solana, Avalanche, or Chainlink add exposure to innovation and new ecosystems but carry higher volatility.

Stablecoins

USDC, USDT, or similar tokens hedge against downturns and keep liquidity available for quick trades or exits.

Utility and Governance Tokens

UNI, AAVE, and similar tokens grant platform access or governance rights, adding both function and diversification.

Caution with Meme Coins

Low-cap or meme tokens can bring big gains but often collapse just as quickly. Keep them as a very small allocation, if at all.

How to Diversify a Crypto Portfolio Intelligently

Diversification is about smart allocation, not collecting coins at random.

Market Capitalization Tiers

Large-cap assets provide stability. Mid-caps bring growth potential. Small-caps carry the highest risk but can deliver outsized rewards.

Sector Exposure

Spread assets across use cases: payments, DeFi, storage, smart contracts, or GameFi. This cushions losses if one sector falters.

Geographic and Regulatory Diversification

Global projects add protection against

local regulation or policy risks. Including multiple blockchain architectures also reduces reliance on one system.

Avoid Over-Diversification

Holding too many tokens dilutes returns and makes tracking performance difficult. If you can’t explain why an asset belongs in your portfolio, it probably doesn’t.

Portfolio Rebalancing: When and Why

Portfolios drift as markets move. Rebalancing restores your intended allocation.

How It Works

When one asset grows disproportionately, you trim it and reallocate to others. This preserves balance and locks in profits.

Timing Rebalancing

Some rebalance quarterly, others when allocations shift by 5–10%. Consistency is more important than frequency.

Consider Costs

Account for trading fees, slippage, and tax implications. Rebalancing should enhance discipline, not erode returns.

Track and Manage Your Portfolio

Monitoring ensures your portfolio stays aligned with your goals.

Manual Tracking

Spreadsheets let you log entries, allocations, and performance if you prefer hands-on control.

Portfolio Apps

CoinStats, Delta, and CoinMarketCap trackers connect wallets and exchanges to give a real-time overview. They simplify analysis and tax reporting.

Exchange Dashboards

Platforms like

AI Crypto Market offer integrated portfolio tools, giving beginners and pros a seamless way to track performance.

Common Mistakes to Avoid

Even seasoned investors can fall into traps that erode returns.

Chasing Hype

Buying tokens based on trends or social buzz often ends in losses once the excitement fades.

Ignoring Correlation

Most altcoins follow Bitcoin’s lead. Holding many correlated tokens doesn’t lower risk—it compounds it.

Overtrading

Frequent trades rack up fees, slippage, and stress. Sometimes, patience pays more than action.

Neglecting Liquidity and Security

Low-volume tokens may trap your funds. And holding assets without proper security measures leaves you exposed to hacks or theft.

Advanced Portfolio Strategies (For Experienced Investors)

Once the basics are mastered, advanced strategies can add sophistication.

ICOs and Presales

High-risk, high-reward opportunities that demand thorough due diligence on teams, tokenomics, and projects.

Crypto Derivatives

Futures, options, and perpetuals allow hedging or leveraged exposure but carry liquidation risks.

DeFi Derivatives and Synthetic Assets

Platforms like Synthetix enable exposure to assets without owning them. Risks include protocol stability and liquidity depth.

Tokenized Real-World Assets

Fractional ownership of real estate, art, or intellectual property is emerging. These assets blend traditional and digital markets but remain experimental.

Final Thoughts

There’s no universal formula for a perfect crypto portfolio. The strongest ones are built on clarity—knowing your goals, your risk tolerance, and your strategy.

Crypto rewards preparation and discipline. A portfolio that reflects structure, not emotion, is far more likely to withstand volatility and deliver results.