July 31, 2025

5 min read

@cryptonews

Strategy unveils a .2 billion ATM equity plan to boost Bitcoin holdings after record quarterly profits.

Strategy Launches $4.2B STRC Equity Program to Expand Bitcoin Treasury

Strategy has launched a new $4.2 billion at-the-market (ATM) equity program for its STRC preferred shares, reinforcing its aggressive equity-to-Bitcoin acquisition strategy. The filing, submitted to the SEC and announced on July 31, 2025, follows the company’s strongest quarterly performance on record and coincides with a significant expansion of its Bitcoin treasury.Strategy Announces $4.2 Billion STRC At-The-Market Program

— Michael Saylor (@saylor) July 31, 2025The STRC program, designed for Variable Rate Series A Perpetual Stretch Preferred Stock, gives Strategy the flexibility to raise capital over time based on market conditions. Proceeds from the offering are expected to support general corporate purposes, including working capital and dividends on previously issued preferred shares. However, consistent with Strategy’s objectives, a major portion is anticipated to be allocated directly to purchasing additional Bitcoin. This move builds on the momentum of four other ATM programs already in operation, each enabling Strategy to convert investor capital into digital assets. This approach aligns with CEO Michael Saylor’s long-standing belief in Bitcoin as a superior corporate treasury asset. The company’s filing indicates its intent to continue leveraging equity markets to support its expanding crypto strategy, which now includes multiple asset classes and preferred share structures.

Saylor’s Strategy: Profits, Bitcoin, and Scalable Capital Programs Amid Soaring Equity Demand

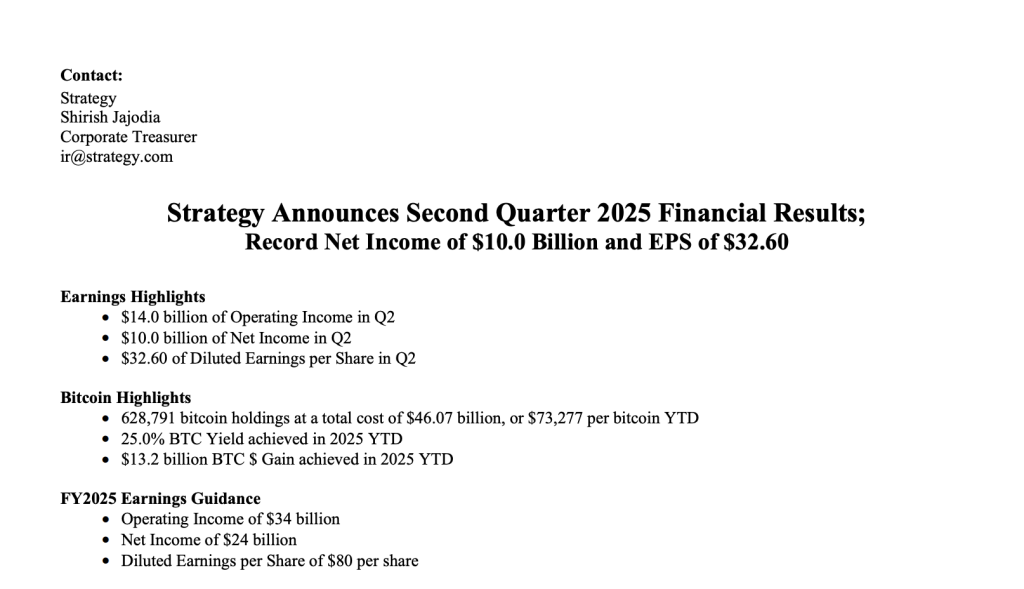

Strategy’s second-quarter earnings report, released shortly after the STRC announcement, showed a sharp rise in profitability. Net income surged to over $2.3 billion, driven by unrealized gains on Bitcoin holdings during a quarter when BTC prices soared above $110,000. This represented a nearly 140% increase from Q1, highlighting the material impact of the company’s digital asset position on its bottom line. Source: Strategy Q2 Financial Results

As of July 29, Strategy’s Bitcoin holdings stood at 628,212 BTC, valued at roughly $69.4 billion. This includes a recent purchase of 14,620 BTC disclosed earlier in the week, acquired using proceeds from existing ATM equity programs.

SEC filings reveal that between July 14 and July 20, Strategy raised over $740 million by selling multiple classes of shares, including common and preferred stock.

Strategy’s capital markets activity has generated more than $10.5 billion in gross proceeds over the last four months. Between April and June, the company secured $6.8 billion through multiple stock issuance programs. An additional $3.7 billion was raised between July 1 and July 29 via public offerings and ATM facilities, with a sizable portion recycled into Bitcoin purchases.

The largest tranche came from Strategy’s Common Stock ATM Program, which raised over $6.3 billion through the issuance of nearly 16.7 million shares. Despite these sales, $17 billion remains authorized under its May 2025 common equity program.

In addition to common equity, Strategy is leveraging preferred shares across several new products. Its STRK ATM program generated over $518 million during the same period, while the STRF ATM program raised approximately $219 million. The company’s May IPO of STRD stock added $979 million, and its follow-up STRD ATM launch in July has raised $17.9 million so far, with $4.2 billion still available.

Source: Strategy Q2 Financial Results

As of July 29, Strategy’s Bitcoin holdings stood at 628,212 BTC, valued at roughly $69.4 billion. This includes a recent purchase of 14,620 BTC disclosed earlier in the week, acquired using proceeds from existing ATM equity programs.

SEC filings reveal that between July 14 and July 20, Strategy raised over $740 million by selling multiple classes of shares, including common and preferred stock.

Strategy’s capital markets activity has generated more than $10.5 billion in gross proceeds over the last four months. Between April and June, the company secured $6.8 billion through multiple stock issuance programs. An additional $3.7 billion was raised between July 1 and July 29 via public offerings and ATM facilities, with a sizable portion recycled into Bitcoin purchases.

The largest tranche came from Strategy’s Common Stock ATM Program, which raised over $6.3 billion through the issuance of nearly 16.7 million shares. Despite these sales, $17 billion remains authorized under its May 2025 common equity program.

In addition to common equity, Strategy is leveraging preferred shares across several new products. Its STRK ATM program generated over $518 million during the same period, while the STRF ATM program raised approximately $219 million. The company’s May IPO of STRD stock added $979 million, and its follow-up STRD ATM launch in July has raised $17.9 million so far, with $4.2 billion still available.

📈 @MicroStrategy doubles down, acquiring 21,021 #Bitcoin after closing the largest U.S. IPO of 2025 worth $2.52B with its new STRC preferred stock. #Strategy #Bitcoin

— Cryptonews.com (@cryptonews) July 29, 2025STRC itself saw a strong cash infusion even before the ATM program announcement. Strategy raised $2.5 billion in its initial STRC stock offering, selling over 28 million shares at $90 each. The preferred stock includes a variable monthly dividend, with the first $0.80 payout declared on July 31 and scheduled for payment on August 31 to shareholders of record as of August 15.

Source: Strategy Raises $4.2B via STRC to Boost Bitcoin Treasury on July 31, 2025