August 11, 2025

5 min read

John Isige

Crypto Today: Bitcoin, XRP Bulls Push for Record High Breakout, Ethereum Consolidates Gains

Bitcoin (BTC) edged higher on Monday, trading around $121,259, reflecting bullish sentiment across the broader cryptocurrency market. This recovery follows last week's surge in speculative demand after BTC found support near $112,000 on August 2. Altcoins such as Ethereum (ETH) and Ripple (XRP) have rallied alongside Bitcoin. Ethereum broke through a multi-year resistance at $4,000 for the first time since November 2021 and extended gains above $4,300. XRP maintains a bullish outlook, targeting its all-time high of $3.66 reached on July 18, supported by renewed institutional interest following Ripple and the US Securities and Exchange Commission's joint motion to drop appeals in their lawsuit.Data Spotlight: Crypto Asset Flows Rebound

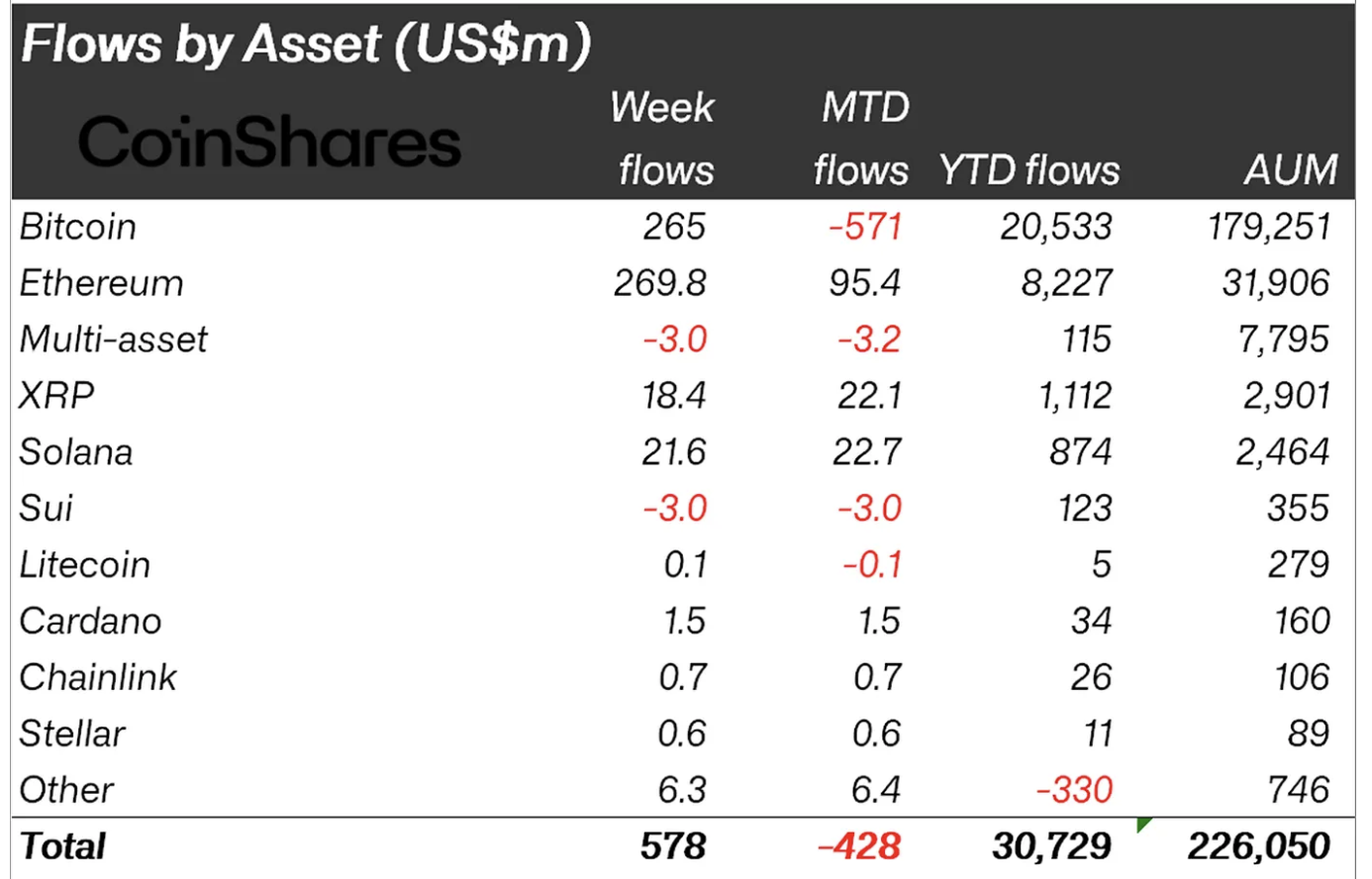

Digital investment products experienced a surge in inflows, totaling $578 million last week, according to a CoinShares report. Ethereum Exchange Traded Products (ETPs) led with over $268 million in inflows, pushing year-to-date inflows to $8.2 billion and total assets under management (AUM) to $31.9 billion—an 82% growth in 2025. Bitcoin investment products also regained momentum with $265 million in inflows last week. Other altcoins like Solana (SOL) and XRP recorded inflows of $21.6 million and $18.4 million, respectively. The inclusion of cryptocurrencies in US 401(k) retirement accounts has boosted interest in digital products, driving prices higher for Bitcoin, Ethereum, and XRP. The CoinShares report noted, "In the latter half of the week, however, we saw $1.57 billion of inflows, likely spurred by the government’s announcement permitting digital assets in 401(k) retirement plans." US-based speculative demand dominated inflows with approximately $608 million, followed by Canada with $16.5 million. In contrast, Europe saw outflows totaling $54.3 million across Germany, Sweden, and Switzerland.

Chart of the Day: Bitcoin Nears Record High

Bitcoin price is seeking higher support after rallying to an intraday high of $122,335. Bulls appear in control, supported by key technical indicators including a buy signal from the Moving Average Convergence Divergence (MACD). Traders may increase exposure as long as the MACD blue line stays above the red signal line and moves higher above zero. The Relative Strength Index (RSI) is approaching overbought territory, indicating rising speculative demand. Key levels to watch include the $120,000 round figure as initial support and the $123,218 record high set on July 14.

Altcoins Update: Ethereum and XRP Show Signs of Consolidation

Ethereum holds near its intraday high of $4,349 after breaking above the four-year resistance at $4,000. Trading at $4,252 at the time of writing, Ethereum’s uptrend is supported by steady retail and institutional demand. The MACD indicator provides a buy signal, with expanding green histogram bars reinforcing the bullish bias and increasing the likelihood of Ethereum challenging its record high above $4,800. However, traders should be cautious as the RSI stabilizes in overbought territory, often a precursor to price corrections. For XRP, bulls remain in control with prices up over 2% on Monday, trading around $3.26. The path of least resistance is upward, supported by uptrending moving averages: the 50-day EMA at $2.88, 100-day EMA at $2.66, and 200-day EMA at $2.39.

For XRP, bulls remain in control with prices up over 2% on Monday, trading around $3.26. The path of least resistance is upward, supported by uptrending moving averages: the 50-day EMA at $2.88, 100-day EMA at $2.66, and 200-day EMA at $2.39.

The MACD could confirm a buy signal if the blue line crosses above the red signal line on the daily chart, encouraging investors to increase exposure. If the RSI continues upward toward overbought territory, it would suggest growing buying pressure and increase the chances of XRP closing the gap to its all-time high of $3.66.

The MACD could confirm a buy signal if the blue line crosses above the red signal line on the daily chart, encouraging investors to increase exposure. If the RSI continues upward toward overbought territory, it would suggest growing buying pressure and increase the chances of XRP closing the gap to its all-time high of $3.66.

Bitcoin, Altcoins, Stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, designed as a decentralized virtual currency that eliminates the need for third-party intermediaries in financial transactions.What are altcoins?

Altcoins refer to cryptocurrencies other than Bitcoin. Some consider Ethereum as a separate category since it is a base for forks. Litecoin is often regarded as the first altcoin, forked from Bitcoin’s protocol.What are stablecoins?

Stablecoins are cryptocurrencies pegged to stable assets like the US Dollar, designed to maintain a stable price. They provide an on/off-ramp for investors and a store of value amid cryptocurrency volatility.What is Bitcoin Dominance?

Bitcoin dominance measures Bitcoin's market capitalization relative to the total cryptocurrency market cap. High dominance typically occurs during bull runs, while a drop indicates capital shifting to altcoins seeking higher returns.Crypto Market AI's Take

The current market sentiment, with Bitcoin pushing towards record highs and Ethereum and XRP consolidating gains, indicates robust investor confidence. The significant inflows into digital investment products, particularly Ethereum ETPs, suggest growing institutional adoption. The integration of cryptocurrencies into retirement plans is a major catalyst, signaling a maturing market. At AI Crypto Market, we leverage advanced AI algorithms to analyze these trends, providing our users with actionable insights for their trading strategies. Our platform is designed to help navigate these volatile yet promising market conditions, offering sophisticated tools for both novice and experienced traders seeking to capitalize on these movements.More to Read:

- Understanding Ripple (XRP) and its Legal Battles

- The Future of Ethereum: What to Expect in 2025 and Beyond

- How AI is Transforming Cryptocurrency Trading

Information sourced from FXStreet, originally published on August 11, 2025.